- Silver short traded on the 30 min chart 1 short signal not the thursday was the risk was too high. I took the short signal friday morning by using last swings distance the measured move pointed to the 2nd target so a 1:3 risk reward trade.

- Crude Oil long traded the 60 Minutes signal 4 times was very cautios and exited at almost every target and/or decision area. I learned if the potential is so great on the daily charts to simply let the trade run till the last target not looking at the PnL :-)

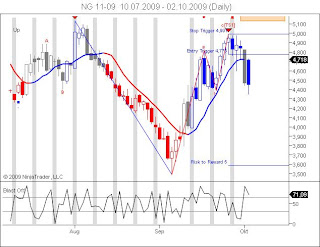

- Natural Gas short traded the 60 Minute short signal because daily charts showed a short signal last friday. Reached the 3rd elliot wave target on tuesday and 5th target on friday morning.

- Gold long 4 entries on 30 min chart. Long signal last friday on daily charts gave me confidence to hold on to the long trade monday morning as it traded below my entry price.

- 30 Year Bonds long very trending bonds required only 2 entries to finally reach the 4rd target after non-farm-payrolls news was releast, this is a trade that can be done almost every month, going long or short after FED Day till first friday of a month.

No comments:

Post a Comment