Monday, January 30, 2012

Monday, January 23, 2012

Thursday, January 19, 2012

Monday, January 9, 2012

Monday, January 2, 2012

Sunday, January 1, 2012

Trading Plan for 2012

I am monitoring major resistance points on the dow index to give me clues about a the next crash and for long entries on the undervalued silver market :-)

So at the beginning of the year there is a clear setup to go long stock indicies (but not stoxx 50), crude oil and soybeans:

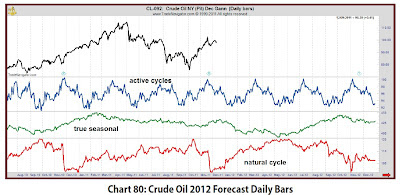

Like the past years, my plan is to trade the natural cycle on the stock market indices and to trade long or short moves at the beginning of each month on crude oil:

Like the past years, my plan is to trade the natural cycle on the stock market indices and to trade long or short moves at the beginning of each month on crude oil:

Lets see of some forecast actually become reality:

Gold:

most rally days where decliners

and most decliners where rally days

june 28th

Dow:

no rally on 22th of febuary

no rally on 22th of febuary

no decline on 4th of januar -50 ticks

all other days profitable so far

especially the 2nd of may drop

no decline on 8th of june

21st of june

especially the 2nd of may drop

no decline on 8th of june

21st of june

Bonds:

no decline on 22th of february

no decline on 20th of march (low of the year)

no decline on 13th of april

no decline on 23th of may

no decline on 4th of june but a reversal of the long trend

29th of june

all other days profitable so far

Subscribe to:

Posts (Atom)

+_+ZB+03-12+(Weekly)++12_20_2011+-+2_3_2012.jpg)

++Week+44_1998+-+Week+11_2012.jpg)

++16_03_2011+-+15_03_2012.jpg)

++3_28_2011+-+5_21_2012.jpg)

++3_18_2011+-+5_18_2012.jpg)