From a seminar of Larry Williams I learned to look at the premium of a commodity, to measure the strength of an instrument.

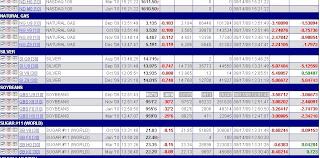

I found this page very helpful for comparing future contracts with current ones.

At the moment only soybeans is trading at a premium, meaning that buyers want it so badly they are willing to pay more for the current contract than for future ones.

I will take a look in the future at the premium spread every week to see which instrument is most bullish and which one most bearish.

Another concept is to simply buy or sell at the close of the friday before options expiration, as you can see on the screenshot a very trending week is often the case in the 3rd week of the month.

One other method is to trade the key reversal pattern, where the low of today has to be lower than yesterdays low but the close is higher than yesterdays close.

On the crude oil market screenshot I marked in the divergence on the accumulation and distrubution line (ADL) and the pullback to the -25% and -75% line of the Williams %R Indicator which offer the best entry opportunties on trending markets (identfied with rising or falling 10 SMA)

Inside Days with Negative Close are Bullish, whereas Inside Days with Positive Close are Bearish

Larry basically closes his swing trades on a 100% extension what he calls the target shooter, I will incooperate his methods into my daily swing trades, to enhance the performance of the ART and Elliot Wave System I am currently using.

No comments:

Post a Comment